pa educational improvement tax credit application

That is when credits are carried forward the amount of credits carried forward will not reduce the amount of credits which an applicant can apply for or use in a subsequent year. Tax credits are typically only available May 15 for existing donors and July 1 for new donors.

Six Tips To Help Your Child Learn To Read Www Papromiseforchildren Com Learn To Read Kids Learning Learning

The Program Guidelines provide more information.

. The Business Application Guide explains the process of applying. For example for a 10000 contribution after August 27 th to an Educational Improvement Organization under the PA EITC program the federal income tax deduction amount would be reduced to 1000 the 10000 contribution paid less the 9000 PA tax credit assuming a 2-year commitment and 90 credit. EITC OSTC Frequently Asked Questions Learn more about the top asked questions for the Educational Improvement and Opportunity Scholarship Tax Credit.

Tom Wolf said Wednesday that he will veto a proposed expansion of Pennsylvanias Educational Improvement Tax Credit which directs millions of potential tax dollars each year to private schools and educational programs. Apply for PA Tax credits available to eligible businesses contributing to scholarship organizations such as CEO America the Childrens Educational Opportunity Fund. About 73 percent of Pennsylvania students.

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made. This program awards tax credits to businesses that make contributions to qualified Scholarship and Educational Improvement Organizations. After submitting your application wait for approval from the state.

May 15 Application Renewals Due. July 2 New Applications Due. Guidelines for this win-win opportunity access httpsdcedpagovdownloadeducational-improvement-tax-credit-program-eitc-guidelineswpdmdl84406.

Access the EITC Business Electronic Application. ImprovementTax Credits to the extentthat suchtax credits remain available for the fiscalyear in which. Tax credit cannot be switched to the more popular Education Improvement EI tax credit in future years.

Go to the PA Department of Community Economic Development DCED Website. Through EITC eligible Pennsylvania. Additionally the REV-1123 Educational Improvement Opportunity Scholarship Tax Credit Election Form will be revised to reflect the carryover provisions.

The Tioga County Foundation is pleased to offer its services as an approved Educational Improvement Organization for the Pennsylvania Educational Improvement Tax Credit EITC Program. Tax credit applications will be processed on a first-come first-served basis by day submitted. For example an organization with a 630 year-end will provide one Part I Fiscal Report for FY end 63018 and a second report for.

The Educational Improvement Tax Credit is a program of the Commonwealth of Pennsylvania administered through the Department of Community and Economic Development that allows eligible businesses to apply tax credits against their tax liability for the year in which the contributions were made. Tax credits may be applied against the state tax liability of an individual for the tax year in which the contribution was made. The first step is to request a PA EITC tax credit from the program.

Applications will be approved until the amount of available tax credits is exhausted. EDUCATIONAL IMPROVEMENT PO BOX 280604. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational opportunities for students in Pennsylvania.

Organizations upto amaximum of750000per taxable yearThe tax credit maybe increasedto 90. Ad Download or Email PA REV-1123 More Fillable Forms Register and Subscribe Now. Eligibility for the scholarships is limited to students from low- and middle-income families.

Individuals can form a Special Purpose Entity SPE to get tax credit applied to personal PA taxes and help low-income children receive quality K-8th grade education. A separate election must be submitted for each year an EITCOSTC is awarded. Pennsylvania businesses can apply for EITC credits through the PA Department of Community Economic Developments electronic single application system which can be accessed by clicking here.

Download File Educational Improvement Tax Credit Program EITC Guidelines Educational Improvement Tax Credit Program EITC Guidelines May 3 2018. Click on the Single Application link under Programs and Funding in the main menu. Volunteers are available at each participating charity to help with this simple no obligation request.

Abusiness firm willbe approvedfor atax credit equalto 75 ofits contributionsto listed. Part I as part of their FY 1920 renewal application. Businesses can apply for a tax credit of up to.

For a two-year commitment a Qualified Individual can receive a 90 tax credit. Pennsylvania Educational Improvement Tax Credit EITC Program PCEF 2017-07-18T135947-0400 Thank You to Our 2016-2017 EITC Donors Phoenixville Community Education Foundation PCEF has been approved by the PA Department of Community and Economic Development DCED as both an Educational Improvement Organization EIO and a PreK Scholarship. Support the Academy through the Educational Improvement Tax Credit Program EITC The Academy of Natural Sciences of Drexel University is a recognized Educational Improvement Organization under the Educational Improvement Tax Credit program EITC of the Pennsylvania Department of Community and Economic Development.

Instead of creating their own SPE individuals may join CSFPs fully-managed SPE and we handle everything. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to expand educational opportunity. But that doesnt mean that the proposal from House Speaker Mike Turzai R-Allegheny is going to disappear anytime soon.

The Pennsylvania Educational Improvement Tax Credit EITC can be very beneficial to companies conducting business in Pennsylvania by reducing tax liability. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners. Participants can send their contribution to the Special Purpose Entity designating the school they want to support.

The PA EITC program receives more requests than it can honor annually so there may be a delay in receiving a tax credit award.

Navigating Financial Success For School And Beyond Loans For Bad Credit No Credit Check Loans Loan Money

Nearly 20 Million Will Benefit If Congress Makes The Eitc Enhancement Permanent Itep

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Hsbc Bank Credit Cards Instant Approval Hsbc Banks Logo Advertising Slogans

New Birth Of Freedom Council Bsa Website For The New Birth Of Freedom Council Bsa

Pay Off Your Debt With A Personal Loan In 2022 Personal Loans Saving Money Chart Money Chart

Earned Income Tax Credit Eitc Definition Taxedu

More Than 80 Percent Of 4th And 8th Grade Students In The School District Of Philadelphia Didn T Reach Proficiency In M Students Safety Student Math Word Walls

Five Ways To Save For A Home Loan Visual Ly Home Loans Home Improvement Loans Loan

Earned Income Tax Credit Eitc Definition Taxedu

What Are Marriage Penalties And Bonuses Tax Policy Center

5 Promises For School Success Pa Promise For Children School Success School Success

Business Invoice Financing Purchase Order Finance Lease Financing Merchant Finance Small Business Lending Small Business Banking

Business Financing Pa Department Of Community Economic Development

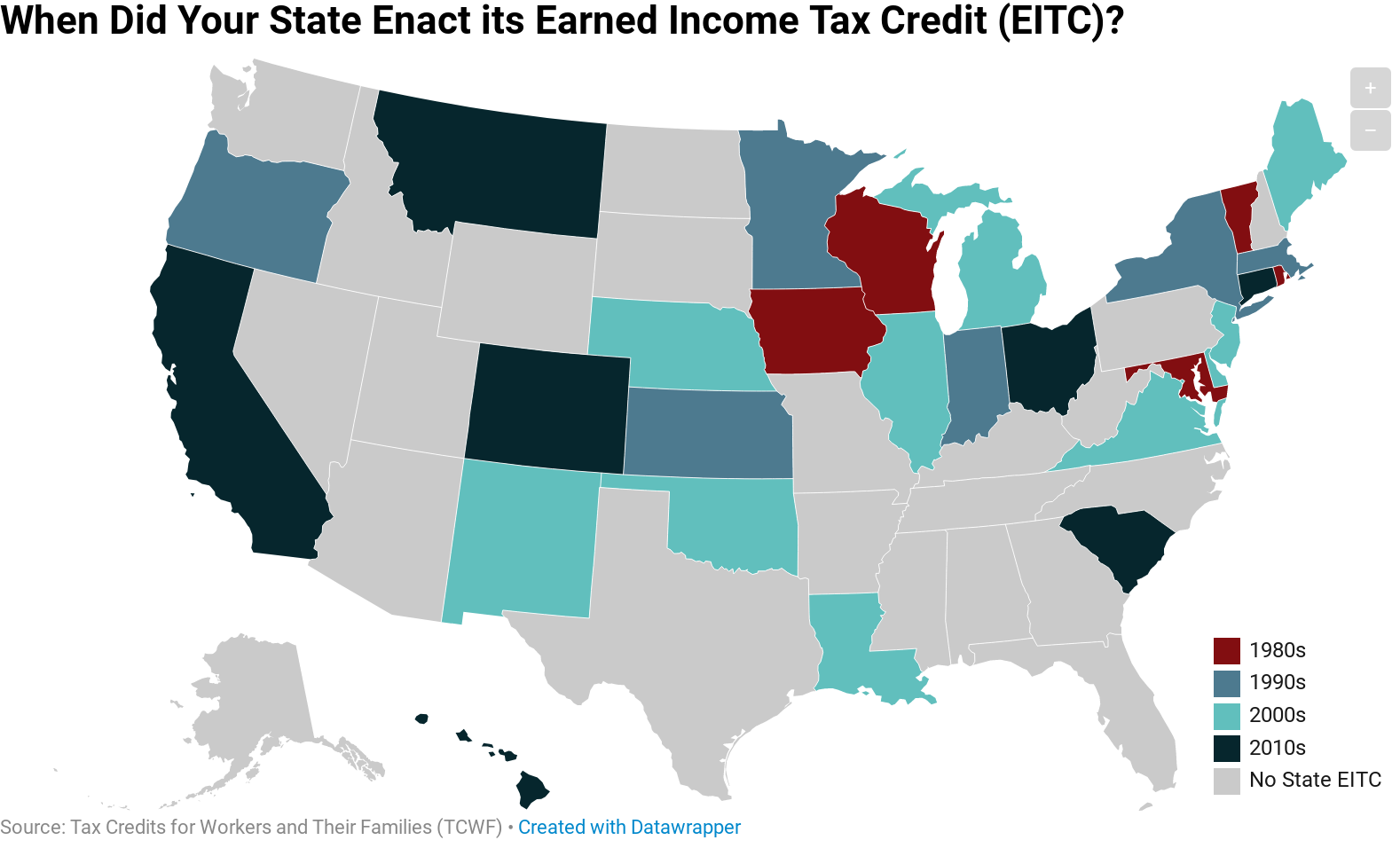

When Did Your State Enact Its Eitc Itep

Western Pennsylvania Montessori School

Earned Income Tax Credit Eitc Definition Taxedu

News Misericordia University Landmark Community Bank Supports Children S Programming At Speech L Speech And Language Programming For Kids Language Disorders